There is no official new $2,000 federal payment confirmed by the IRS for January 2026, and no universal automatic direct deposit has been authorized by law. Some people may receive refunds or credits near that amount based on their tax situation, but it’s not a new “stimulus” check for everyone.

What People Are Talking About

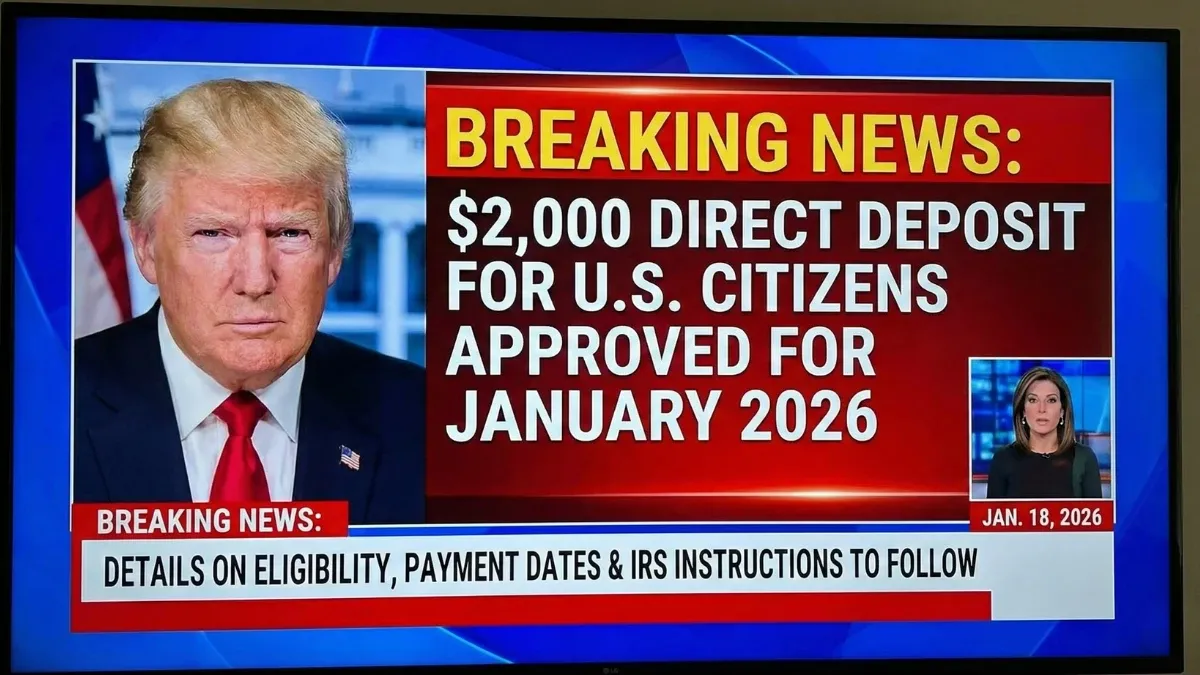

Rumors about a $2,000 direct deposit for January 2026 started circulating on social media and many websites. Some stories say the IRS will send a one-time payment early in the year, while others tie the idea to proposals like a “tariff dividend” from the federal government.

At the same time, major news outlets and tax-related fact checks are clear: no new $2,000 stimulus payment or direct deposit has been approved by the IRS or Congress for January 2026. Officials have not released an official schedule for such a deposit tied to a new benefit program.

Some of the viral articles you might see are misleading or based on proposals that are not law yet. Legislators would have to pass new legislation for a nationwide payment, and that hasn’t happened.

| Claim Type | Status |

|---|---|

| New $2,000 IRS direct deposit for all Americans | ❌ No official approval |

| Rumored payment in January 2026 | ⚠️ Online rumors exist |

| Federal law authorizing new payment | ❌ Not passed |

Why Some People Might Actually See $2,000

Even though there’s no universal $2,000 check, plenty of Americans will get tax refunds or credits in January or early 2026 that could be around $2,000 or more — depending on their individual tax situation. This includes:

- Standard federal tax refunds

- Refunds from credits like the Earned Income Tax Credit (EITC)

- Refunds from the Child Tax Credit (CTC)

- Late corrections or overpaid tax returns from previous years

These are refunds — not new stimulus payments. They depend on what you file with the IRS and how much tax you overpaid or credits you’re eligible for. Some people receive these amounts via direct deposit if they chose that method.

| Common Refund Types | How They Can Reach $2,000 |

|---|---|

| Standard refund | Overpayment of taxes |

| EITC | Refundable for low/moderate income |

| CTC | Refundable portion increases refunds |

| Withholding adjustments | Can boost refund totals |

Understanding IRS Tax Refund Timing

The IRS generally processes tax returns and refunds on a schedule once the year opens. For most people, filing early and choosing direct deposit can help you get money faster if you’re owed a refund. Typically:

- Early January 2026: Tax filing season starts

- Within 7–21 days after filing: Many direct deposits arrive

- Late January to early February: Mail checks or slower refunds appear

These timelines are based on usual IRS refund processing — not a new program.

| Processing Step | Typical Timeframe |

|---|---|

| IRS starts accepting returns | Mid to late January |

| Direct deposit refunds | ~7–21 days after acceptance |

| Mail checks | ~3–6 weeks after acceptance |

If you see a deposit of about $2,000 in your bank account, it’s more likely a refund or credit payment than a pre-arranged universal direct deposit from the IRS.

How to Know If You’re Eligible for Refunds

You don’t need to worry about being “eligible for a $2,000 payment” unless it’s part of your normal tax refund. Here’s what determines your refund amount:

- Income level

- Tax credits you claim (like EITC or CTC)

- How much tax you paid during the year

- Filing status (single, married filing jointly, etc.)

- Whether you file early and choose direct deposit

If you haven’t filed your taxes or don’t usually file because you made very little income, you might use the IRS non-filer tool to submit your details so the IRS can issue any refunds you deserve. But this is still about refunds — not a new stimulus program.

| Eligibility Factor | How It Affects Your Refund |

|---|---|

| Income | Determines credits you qualify for |

| Filing status | Affects refund size |

| Credits claimed | Can boost refund |

| Direct deposit choice | Faster delivery |

Scam Warnings and What to Watch For

Whenever big-number “$2,000 payments” start trending online, scammers jump in. Be careful with:

- Emails asking for personal details or bank numbers

- Websites claiming an “IRS payment portal”

- Forms that want your password or SSN for fast money

The real IRS will not contact you via text or social media asking for banking details, and they won’t send anyone to expedite your payment. Always check irs.gov or official IRS channels for real information.

| Scam Red Flag | Watch Out For |

|---|---|

| Unofficial emails | Fake IRS lookalikes |

| Social media messages | Scam links |

| Requests for personal info | SSN/bank details |

Bottom Line: What You Should Know

There is no official uniform $2,000 IRS payment scheduled for everyone in January 2026. What is real are regular tax refunds and credits, which could be around $2,000 depending on your situation. Be cautious of rumors, double-check facts on official IRS pages, and rely on your tax return and refund status rather than posts on social media.

If you want, I can also provide official IRS links where you can check your refund status and see real timelines

Skip to content

Skip to content